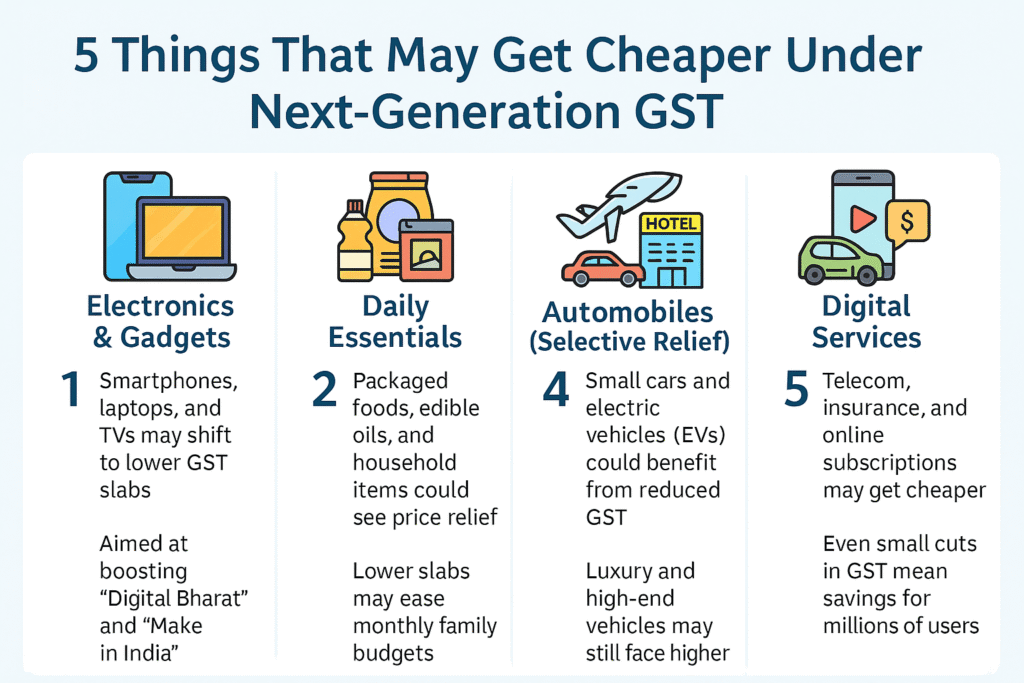

Next-gen GST reforms may cut prices on electronics, daily essentials, travel, EVs, and digital services. Here’s what could get cheaper under the new tax system.

Electronics & Gadgets

- Smartphones, laptops, and TVs may shift to lower GST slabs.

- Aimed at boosting “Digital Bharat” and “Make in India.”

Daily Essentials

- Packaged foods, edible oils, and household items could see price relief.

- Lower slabs may ease monthly family budgets.

Travel & Hospitality

- Domestic airfares, restaurants, and hotels may become more affordable.

- A push to revive India’s tourism sector.

Automobiles (Selective Relief)

- Small cars and electric vehicles (EVs) could benefit from reduced GST.

- Luxury and high-end vehicles may still face higher taxes.

Digital Services

- Telecom, insurance, and online subscriptions may get cheaper.

- Even small cuts in GST mean savings for millions of users.

A Big Shift in India’s Tax Landscape

India’s Goods and Services Tax (GST) is once again under the spotlight as policymakers prepare for the next wave of reforms. The goal: simplify the multi-tier system, reduce tax disputes, and give consumers visible relief. With discussions in advanced stages, the focus is now on what ordinary citizens will actually feel in their wallets—what might get cheaper once these changes roll out.

Electronics and Gadgets May See Price Cuts

Consumer electronics—especially smartphones, laptops, and televisions—are strong candidates for tax reduction. Presently, many gadgets fall into the 18% or 28% GST bracket. If rates are rationalized into a slimmer structure—say, two or three slabs instead of four—the burden on mid-range electronics could fall.

Industry insiders suggest that a reduction could boost India’s “Digital Bharat” mission, making technology more affordable for students, professionals, and small businesses. The government also hopes it will fuel domestic demand while supporting “Make in India” manufacturing.

Daily Essentials Could Benefit

While most food items such as fresh produce are already exempt or taxed at minimal rates, packaged goods and household essentials often fall in the 5% to 12% GST range. A streamlined tax system may push certain household necessities into lower slabs, directly easing the monthly budget for families.

Analysts believe that essentials like packaged cereals, edible oils, and personal care items may see marginal price relief—especially if cascading tax disputes are reduced.

Travel and Hospitality Might Become More Affordable

Air travel, restaurants, and hotel stays often spark debate in GST councils. Currently, high-end hotels and premium travel attract 18% to 28% GST, while budget categories pay less. Reformers argue for a simpler structure with reduced slabs, making tourism and business travel more competitive.

This could be a strategic move to boost India’s domestic tourism sector, helping middle-class travelers and reviving the hospitality industry post-pandemic.

Automobiles and Two-Wheelers: Still a Question Mark

One of the hottest debates is over vehicles. Automobiles and two-wheelers fall under the highest GST slab of 28%, plus additional cess. Industry leaders argue that reducing this tax could boost sales, generate jobs, and revive the auto industry. However, the government remains cautious—vehicles are a big revenue source, and cuts could strain state finances.

Still, whispers in policy circles suggest that small cars and electric vehicles (EVs) may see relief as part of India’s green transition strategy.

Services Sector Relief

Services such as telecom, insurance, and online streaming currently fall in the 18% bracket. A rationalized GST rate might cut this down slightly, making internet services and entertainment more affordable. For an economy increasingly reliant on digital connectivity, even a 2–4% cut could translate into big consumer savings.

Conclusion: Cheaper, But Selectively

The next-generation GST reforms aim not just to reduce rates but to simplify India’s tax architecture. While luxury items may continue to bear higher taxes, essentials, technology, and travel services stand a strong chance of becoming more affordable.

As with all reforms, the fine print will matter. The real test lies in balancing consumer relief with government revenue needs. Until the GST Council unveils its final blueprint, India waits with hope—for a simpler system, and a cheaper daily life.

FAQs

1. What is the purpose of the next-generation GST reforms?

To simplify tax slabs, reduce disputes, and make the system more transparent and consumer-friendly.

2. Which items are most likely to get cheaper?

Electronics, packaged essentials, hospitality services, and possibly electric vehicles.

3. Will fuel and alcohol be included in GST reforms?

Not immediately. Both remain outside the GST framework, though debates continue.

4. How many tax slabs may remain after reforms?

Experts expect two or three main slabs instead of the current four-tier structure.

5. When will the new GST rates come into effect?

Reforms are under discussion in the GST Council; implementation timelines will depend on state-federal consensus.