Dhaka, March 30:

Bangladesh’s reliance on Indian imports has risen significantly in recent months as local manufacturers and exporters struggle to meet shrinking lead times imposed by global buyers. With the international supply chain becoming increasingly competitive post-Covid-19 and amid ongoing geopolitical and economic instability, India has emerged as a convenient and time-saving source for raw materials — especially for the textile and garment industries.

Local manufacturers say importing raw materials from distant countries such as China, Latin America, or Africa is no longer feasible in today’s fast-paced export environment. These longer routes can result in up to 45 days of transit time, thereby eroding the competitive advantage of Bangladeshi exporters, particularly those in the readymade garment (RMG) sector. In contrast, sourcing the same goods from India takes just two to three days — at lower costs — giving Indian products a significant edge.

Since July 2024, the import of Indian goods like cotton, yarn, fabrics, handloom products, and chemicals has seen a marked increase, triggered by political and labor unrest in Bangladesh that disrupted manufacturing and port activities. According to Bangladesh Bank data, imports from India rose by 2.09% in the October–December quarter of 2024, reaching $2.36 billion, up from $2.04 billion during the same period in 2023.

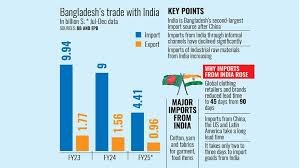

In the first six months of FY25, Bangladesh imported $4.41 billion worth of goods from India, with projections indicating a year-end total that could exceed the $9 billion recorded in FY24 — though still slightly less than the $9.94 billion imported in FY23.

Cotton remains the top import, with more than half of Bangladesh’s $3 billion annual cotton imports coming from India. In FY24, imports of Indian cotton rose to $2.36 billion, up from $1.92 billion in FY23. The short delivery time and cost-efficiency have made Indian cotton a top choice, especially as retailers globally have slashed lead times from 90 days to just 45 days.

Before the COVID-19 pandemic, Bangladesh had reduced its dependency on Indian cotton due to frequent supply disruptions. But current global trends and logistical convenience have led to a reversal, with local mills again turning to Indian suppliers. Showkat Aziz Russell, president of the Bangladesh Textile Mills Association (BTMA), noted that manufacturers are “bound to rely more on Indian goods” to survive in today’s fast-paced market.

Additional Factors Fueling the Surge in Indian Imports:

- Reduced informal trade due to enhanced border vigilance by both nations.

- Functioning infrastructure: 24 land ports, 3 rail ports, along with seaports and airports, make India a logistically accessible partner.

- Financial ease: Many international banks are reluctant to honor letters of credit (LCs) from Bangladesh due to ongoing dollar shortages. Indian trade partners remain flexible under these conditions.

Dr. Mohammad Abdur Razzaque, chairman of the Research and Policy Integration for Development (RAPID), emphasized the complementarity of India’s economy with Bangladesh’s industrial needs. In addition to proximity, shared language and cultural similarities also contribute to the growing dependence on Indian raw materials.

While imports from India have soared, Bangladesh’s exports to India have seen a downturn, despite duty-free access. In the first half of FY25, Bangladesh exported $970 million worth of goods to India, mainly garments. In FY24, total exports dropped to $1.56 billion, a 11.63% decline from FY23’s $1.77 billion, due to limited product diversification.